The popularity of glucagon-like peptide-1 (GLP-1) weight loss drugs has skyrocketed recently, and it’s no wonder when you consider the impact these drugs can have on people’s lives. However, GLP-1 weight loss drugs also come with a large financial impact on employers, leading to them balancing the financial implications with investing in their employees’ health by covering GLP-1s.

The popularity of glucagon-like peptide-1 (GLP-1) weight loss drugs has skyrocketed recently, and it’s no wonder when you consider the impact these drugs can have on people’s lives. However, GLP-1 weight loss drugs also come with a large financial impact on employers, leading to them balancing the financial implications with investing in their employees’ health by covering GLP-1s.

Investing in Employees’ Health: The Impacts of GLP-1 Weight Loss Drugs

The benefits of GLP-1s don’t just stop with the person taking the GLP-1—they also extend to their employer. Some of the benefits of GLP-1 weight loss drugs include:

Improved Health Outcomes

One of the top benefits of GLP-1 weight loss drugs is improved health outcomes. GLP-1 drugs can help people lose up to 15-20 percent of their body weight, which helps people with type 2 diabetes or obesity manage their risk for other conditions.

GLP-1s can help reduce the risk of complications from conditions such as cardiovascular disease, high blood pressure, high cholesterol, kidney failure, and more—or potentially reverse these conditions altogether. As a result, members taking GLP-1s may experience fewer hospitalizations and emergency room visits, which, in turn, can lower healthcare costs.

Reduced Absenteeism

By helping employees with weight management strategies such as GLP-1s, those who take these medications can better manage their risk for other conditions, which has a large impact on productivity and absenteeism. A healthier workforce can help reduce absenteeism, improve productivity, and reduce indirect costs from lost productivity due to illness.

Positive Impact on Employee Quality of Life

GLP-1s have a positive impact on many facets of life for employees with type 2 diabetes or obesity. By losing weight and improving their risk for other conditions, members who take these medications may experience a boost in their mental health and self-esteem, which can improve their personal outlook and social life. Plus, reducing the risk of chronic conditions can lead to financial relief from costly medications used to treat these conditions.

What Employers Should Consider

Even though GLP-1s have plenty of benefits for employers and employees alike, they are expensive. Annual costs for GLP-1s can exceed $11,000 per member taking the medication.

Employers should weigh the up-front costs against the potential savings to determine if GLP-1s are a good fit for their health plan. Some factors to consider include:

Behavioral Changes

GLP-1 weight loss drugs are only effective for weight loss management when combined with other lifestyle changes, such as diet and exercise. Approximately two-thirds of people stop taking GLP-1s within a year. To set your employees up for success, it’s important to ensure they have the tools they need to succeed on their weight loss journey. To do this, employers should ensure they have a comprehensive benefits plan with health resources such as nutrition education, coaching, and exercise support.

Understanding of GLP-1s

GLP-1s were initially developed to treat type 2 diabetes by mimicking the GLP-1 hormone, which controls blood glucose levels and insulin. They were then found to be effective for weight management. However, with the rise in popularity of GLP-1 weight loss drugs, there’s also been a rise in myths circulating about these medications, such as that “natural semaglutide” provided by some medical spas is a cost-effective way to treat obesity.

As such, there is a disparity in understanding of GLP-1s among employers and even among HR leaders. Many employers and HR leaders know about GLP-1s but may not fully understand what they’re used to treat. Understanding what they’re used for can greatly impact whether these medications are covered. Given the popularity of GLP-1s and their efficacy in treating type 2 diabetes and helping to manage weight loss, they aren’t going anywhere.

It’s critical for employers to understand these medications, what they’re used for, and how they’ll cover them. This is especially important because, as research on GLP-1 weight loss drugs progresses, they’ll likely be approved for new indications. Additionally, more cost-effective and convenient GLP-1s could be developed that would bring more competition.

Communication

A benefits package is a key recruitment and retention offering, but if employers don’t do a good job at communicating available benefits, including costs and value, employees could be missing out on key benefits, and both employers and employees could spend more on healthcare costs.

Employers should communicate clearly about when and how to use specific benefits and the value of these benefits. This could include using healthcare vendor communications, customizing messaging, providing print communications, or offering face-to-face meetings.

Alternate Prescription Sourcing

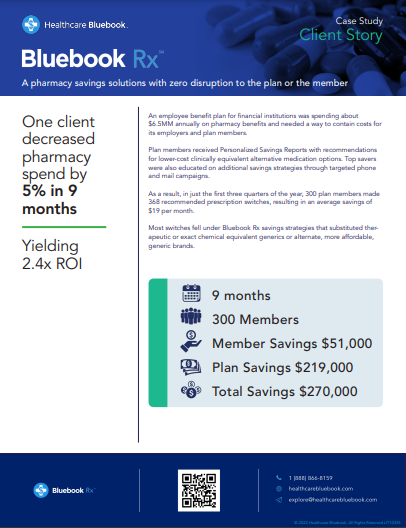

Coupons and co-pay cards can help reduce prescription costs that otherwise may not be covered, especially for medications such as GLP-1s. An additional strategy that can be used to reduce overall pharmacy spend is Bluebook Rx. This program helps members and employers save by identifying overpriced medications and suggesting lower-cost alternatives.

Healthcare Bluebook recently launched an expansion of Bluebook Rx that addresses the increasing costs of GLP-1 weight loss drugs, resulting in a bundled solution that enables employers and employees alike to lower their GLP-1 medication costs.

Improve Employee Well-Being While Managing Prescription Costs

With the right solutions, you don’t need to choose between employee well-being and managing prescription costs. You can do both with Bluebook Rx, enhanced by Vālenz Health® integrated health platform. See how other companies have done this and the results they experienced with the Bluebook Rx case study.